Harshad Mehta was the biggest scammer of the 90s era. He had done the biggest scam ever in the stock market. The story of a small businessman of a small stock market company, becoming the biggest king of the stock market is very interesting. He changed the condition of the stock market in 1990 and shook the financial market of the entire country. It is said about Harshad that at that time, the stock on which he used to lay his hands became gold. Let’s Know about Harshad Mehta Death Reason and biography.

Who Is Harshad Mehta?

Harshad Mehta was an Indian broker known as the big bull of the Indian stock market. Mostly we know him due to his 1992 scam. He performed India’s biggest stock market scam.

Real Facts

Harshad Mehta was born in 1954, wife Jyoti Mehta, they have one child Aatur Harshad Mehta. Harshad did his schooling in Raipur after that he moved to Mumbai and did his b.com from Lala Rajput college. After graduation, he worked in many different companies for some years. He does not even know about himself that what would be his future.

During this, he developed an interest in the stock market. He then left the job and joined the broker B.Ambalal.He later became a broker of J S Shah and Nand Lal Sheth. Afterward in a meantime, he understood well the stock market.

Started Company

In 1984, started a company with his brother by the name of Grow More Research and assets management and become the broker of BSE, and started his own career.

Harshad Mehta Scam

Harshad Mehta used the RF deal- Ready Forward deal in his scam, What is an RF deal? Basically, in this the government issue securities in a few of its projects to cover their expenses. These are known as Government Securities. For example government bonds through which government raise fund to cover its expenses.

In return, the government provides interest to all of its investors, and all banks need to invest a certain amount in these securities. And it is used to aid loans for the short-term.

Whenever a bank needed funds, it used to sell its government securities to the other bank and it used to avail the loan for the short-term. And after a few days, the bank would have its government securities back after returning the loan at the agreed interest rate.

In Simpler Terms

it’s like going to a jeweler and borrowing money for your jewelry and then after a few days, you get your jewelry back from the jeweler after returning the money with interest.

Similarly, in a ready-forward deal, one bank used to provide short-term loans to the other bank. In a ready-forward deal, brokers used to work as mediators for the banks. To find buyers for those who want to buy and find sellers for those who want to sell.

Harshad Mehta was also a broker and therefore, worked as a mediator for the banks, there was some defect in the RF deal, one could have made money with the help of these and he started using them for his personal benefit.

Examples

Just suppose there are 4 banks A B C&D, Harshad used to search for buyers to sell the securities of bank A, then he used to go to bank B, take the securities money and ask for some time to get the seller. He used to keep the security given by Bank A, as well as cash from Bank B.

(As per the guidelines issued by the Reserve Bank of India, no bank was supposed to issue a direct check in the name of the broker.)

But in this case, the bank was issuing a check directly in the name of the broker in the name of Harshat Mehta.

Surprisingly, most banks were not even aware that they were doing business with the banks because the banks had direct dealings with Harshad Mehta.

This is the reason why Harshad asked the banks to issue a check in his name. As a broker, Harsh has performed well in the stock market for several years, besides he was very popular in the stock market those days and took advantage of this opportunity. He Uses this money, got from the bank to manipulate the stock market by raising the share price.

When Bank A was requesting securities, Harshad was looking for another bank seeking to buy government securities. Suppose if Bank C was also looking for securities, then Harshad used to go to Bank C and ask them for money. Then he asked for some time to return the money.

Meanwhile, he returned the same amount to Bank A to complete deals with Bank C and D, he was doing the same thing with the other banks too. Harshad used the RF deal as a chain system that helped him have a lot of money in his hands.

Note – When a bank used to sell bank securities to other banks for the short term, then the bank used to give them a receipt instead of the actual bank securities.

The bank receipt means that government securities have been sold and the bank has gotten its money.

Harshad took another scam step when he needed more money, crossed all limits, and started issuing fake bank receipts with the help of a few banks. Banks who wanted to buy government securities, Harshad used to give them a fake receipt.

Banks used to hand money over to Harshad thinking the bank receipts were original. Harshad used this money to manipulate more shares and take them to a higher level.

Since 1990 he started to become famous almost every newspaper and magazine showed his face. People used to think that whatever stake Harshad Mehta was buying automatically went up the share price. Just like, when he bought ACC stock at 200 after purchasing it, he managed to increase his share price to Rs 9,000 in some months.

After seeing the sudden growth in the stock market, many people started investing in stocks. This led to a rise in stock prices in the stock market.

When stock markets were going up, Harshad used to sell his shares, return the bank money, and get his fake receipt back. This continued until the share price rose, and suddenly the stock prices began to decline. Harshad began to incur losses and was unable to return the bank money.

Sucheta Dalal

Then on 23rd April 1992, Sucheta Dalal exposed the scam Harshad Mehta in TOI’s article. This is how the banks came to know that the receipts given by Harshad were fake and they hold no value. The banking system faced a huge loss of around 3000-4000 crore rupees. When the scam was exposed, the stock market was crashed badly and a lot of investors suffered huge losses.

The chairman of Vijaya bank committed suicide after the news of the Harshad scam was exposed. Banks started asking him for money, but Harshad was not able to return the money due to the market crash. Before the scam was exposed, no one had an idea of Harshad’s technique of doing a scam.

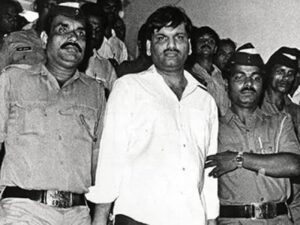

Harshad Mehta Death Reason

lastly, CBI got the order to investigate this matter and found them guilty CBI arrested Harshad Mehta and his brother on 9 Nov 1992. He was charged with 600 civil action suits and 70 criminal cases.SEBI had banned him from investing in the stock market forever.

In one of his press conferences, Harshat Mehta blamed prime minister Narasimha Rao to give him a 1 crore rupees bribe, but congress denied that allegation.

In 2001 Mehta again got arrested by the CBI police, lastly on 31 December 2001, he died due to a heart attack.

According to RBI 1992, his scandal was 400025 crore in which the highest scandal with SBI with 6000 crores.

Movies & Web Series

Upcoming movie on his biography – The Big Bull

Web series –Scam 1992

Read next about Nambi Narayanan

Covered Question:

Harshad Mehta Death Reason?

Leave a Reply